Veritaas Advertising Limited

Company Overview:

Veritaas Advertising Limited is a comprehensive advertising agency that provides 360-degree services across various platforms.

The company was incorporated on July 31, 2018.

They specialize in outdoor and retail branding solutions, helping brands increase their visibility and engage with customers effectively12.

With over 30 years of experience, Veritaas believes that advertising plays a significant role in ensuring brand success. Their branding strategies aim to be impactful, unique, flamboyant, and formidable, making brands the “Choice of Customers.”

Geographical Presence:

Veritaas owns advertising spaces in West Bengal, Guwahati, and Shillong.

They also operate in Delhi, Mumbai, and Pune3.

Importance of Advertising:

In today’s dynamic technological landscape, choosing the right advertising solutions and platforms is crucial.

Advertising offers several benefits, including:

Increasing brand awareness.

Educating customers.

Attracting new customers.

Retaining loyal customers.

Boosting sales and conversion ratios.

Supporting other business operations.

Creating value for the brand.

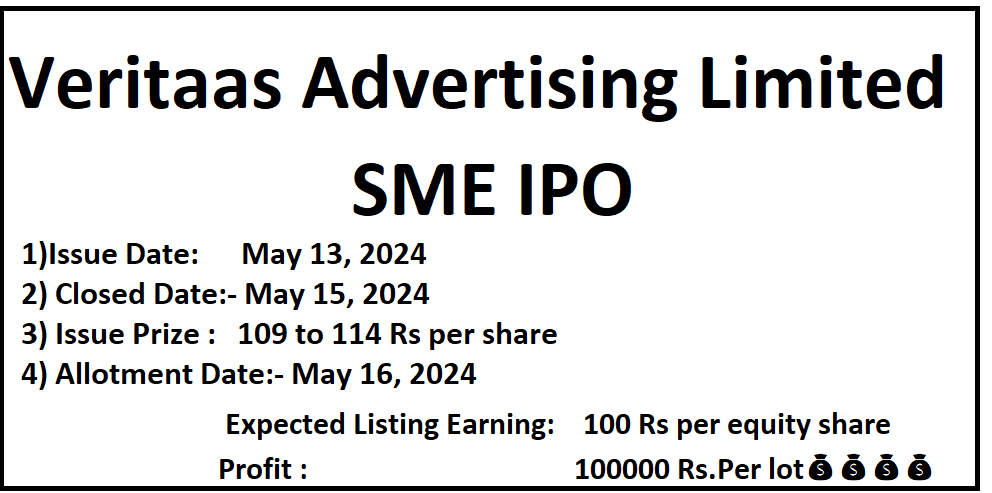

Veritaas Advertising Limited – SME IPO

Details Below

1) Issue Date: May 13, 2024

2) Closed Date: May 15, 2024

3) Issue Prize : 109 to 114 Rs per share

4) Allotment Date:- May 16, 2024

5) Initiation of Refunds: May 16,2024

6) Credit of Shares to Demat: May 20,2024

7) Listing Date :- May 21 ,2024

8) Lot Size: 1200 share (Minimum investment Rs 136800)

9) Expected Listing Earning: 100 Rs per equity share

10) Profit : 100000 Rs. Per lot💰💰💰

11) Listing At: NSE SME