HOAC Food India Limited IPO

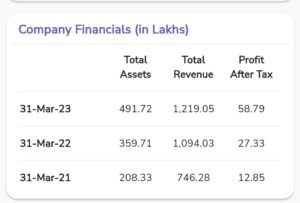

About Company :

HOAC Foods India Limited, established in 2018, specializes in manufacturing flour, spices, and other food items under the brand name “HARIOM.” They operate through 10 exclusive outlets in and around Delhi-NCR. Their diversified product portfolio includes chakki atta (flour), herbs, unpolished pulses, grains, and yellow mustard oil13.

Listing Date: The shares are proposed to be listed on the NSE-SME on May 24th, 20241.

Strengths of HOAC Foods India Ltd: Experienced management team with domain knowledge.

Unique and sustainable business model.

Diversified product portfolio capturing the growing Indian spice market.

Omni-channel approach.

Cluster-based distribution through retail outlet networks.

In-house manufacturing capabilities.

Consistent focus on quality and nutritional value.

Strong and stable management team with proven ability.

Long-standing customer relationships.

Risks Involved:

The company must obtain, renew, or maintain statutory permits and approvals to operate its business and manufacturing facility.

Some products are procured from third-party suppliers1.

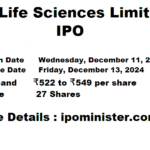

HOAC Food India Limited IPO Details

1) Issue Date: May 16, 2024

2) Closed Date:- May 21, 2024

3) Issue Prize : 48 Rs per share

4) Allotment Date:- May 22, 2024

5) Initiation of Refunds: May 23, 2024

6) Credit of Shares to Demat: May 23 ,2024

7) Listing Date :- May 24 ,2024

8) Lot Size: 3000 share (Minimum investment Rs 144000)

9) Expected Listing Earning: 95 Rs per equity share

10) Profit : 220000 Rs.Per lot💰💰💰💰

11) Listing At: NSE SME

Disclaimer:

Accuracy and Information:

The content on the IPO Minister website is for informational purposes only. While we strive to provide accurate and up-to-date information, we recommend verifying details independently.

Our analysis, insights, and guidance are based on available data, but market conditions can change rapidly.

Not Financial Advice:

IPO Minister does not offer personalized financial advice or investment recommendations. Consult with a qualified financial advisor before making any investment decisions.

Users should conduct their due diligence and consider their risk tolerance before participating in IPOs.

Risk Disclosure:

Investing in IPOs involves risks, including market volatility, company-specific risks, and regulatory changes.

Past performance is not indicative of future results.

Third-Party Links:

Our website may contain links to external websites. We do not endorse or guarantee the accuracy of content on these third-party sites.

Users should review the privacy policies and terms of use of linked websites.

Privacy and Cookies:

Refer to our Privacy Policy for details on data collection, usage, and protection.

Consult Legal Professionals: